Are you looking for books on FIRE (Financial Independence, Retire Early) or managing your personal finance ? If the answer is yes then you are at the right place. We have compiled a list of top books on FIRE (Financial Independence, Retire Early) . These books will help you in coming up with strategy and provide you actionable steps to achieve financial independence.

What is the fire (Financial Independence, Retire Early) movement ?

It is a philosophy to save and invest aggressively in the early stage of your life so that you have enough wealth accumulated to retire early.

The Richest Man in Babylon

To bring your dreams and desires to fulfillment, you must be successful with money. This book shows you how to amass personal wealth by sharing the secrets of the ancient Babylonians, who were the first to discover the universal laws of prosperity.

Hailed as the greatest of all inspirational works on the subject of thrift, financial planning, and personal wealth, The Richest Man in Babylon is a timeless classic that holds the key to all you desire and everything you wish to accomplish. Through entertaining stories about the herdsmen, merchants, and tradesmen of ancient Babylon, George S. Clason provides concrete advice for creating, growing, and preserving wealth. Beloved by millions, this celebrated bestseller offers an understanding of, and a solution to, your personal financial problems. This is the book that holds the secrets to keeping your money and making more.

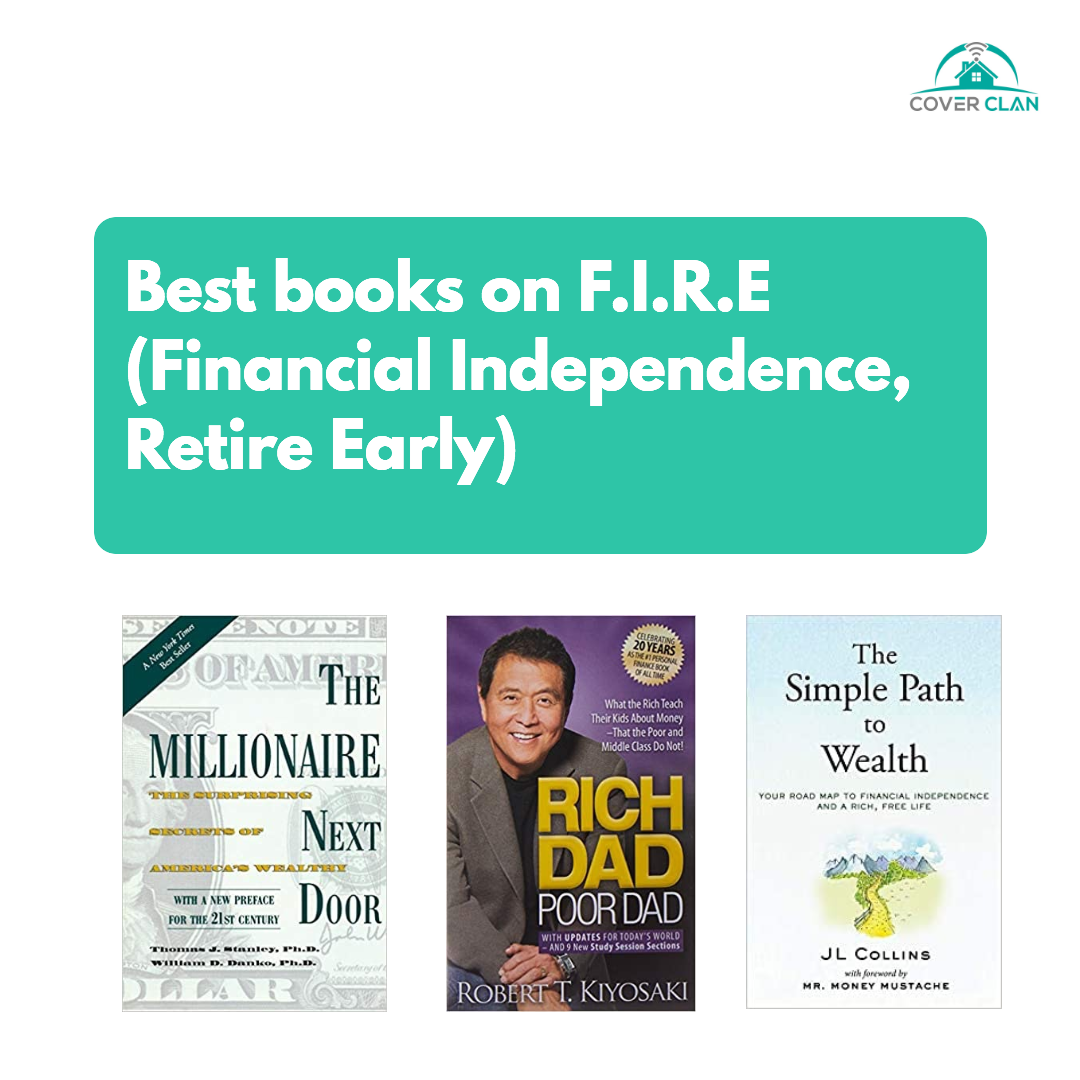

The Simple Path to Wealth: Your road map to financial independence and a rich, free life

In the dark, bewildering, trap-infested jungle of misinformation and opaque riddles that is the world of investment, JL Collins is the fatherly wizard on the side of the path, offering a simple map, warm words of encouragement and the tools to forge your way through with confidence. You’ll never find a wiser advisor with a bigger heart.

This book grew out of a series of letters to his daughter concerning various things—mostly about money and investing

I Will Teach You to Be Rich, Second Edition: No Guilt. No Excuses. No BS. Just a 6-Week Program That Works

Personal finance expert Ramit Sethi has been called a “wealth wizard” by Forbes and the “new guru on the block” by Fortune. Now he’s updated and expanded his modern money classic for a new age, delivering a simple, powerful, no-BS 6-week program that just works.

This book provides a different approach to saving and spending. Many people think that in order to be financial independent one has to be frugal but that is not necessarily true. This book teaches you to identify your money dials and spend on things which makes you happy and save on high ticket items which you may be neglecting.

Choose FI: Your Blueprint to Financial Independence

Meet Brad Barrett and Jonathan Mendonsa of the award-winning ChooseFI podcast and Chris Mamula of the popular blog “Can I Retire Yet?”. They have walked the talk and now want to share their knowledge with you. Together, these three regular guys will show you how they made the relatively simple choices to reclaim decades of their lives, and how you can too.

The Total Money Makeover: Classic Edition: A Proven Plan for Financial Fitness

Author: Dave Ramsey

This book’s main mantra is to get debt free. It provides a lot of easy to follow strategies which will lead you to financial independence.

- Design a sure-fire plan for paying off all debt—meaning cars, houses, everything

- Recognize the 10 most dangerous money myths (these will kill you)

- Secure a big, fat nest egg for emergencies and retirement!

Quit Like a Millionaire: No Gimmicks, Luck, or Trust Fund Required

Kristy Shen retired with a million dollars at the age of thirty-one, and she did it without hitting a home run on the stock market, starting the next Snapchat in her garage, or investing in hot real estate. Learn how to cut down on spending without decreasing your quality of life, build a million-dollar portfolio, fortify your investments to survive bear markets and black-swan events, and use the 4 percent rule and the Yield Shield–so you can quit the rat race forever. Not everyone can become an entrepreneur or a real estate baron; the rest of us need Shen’s mathematically proven approach to retire decades before sixty-five.

Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!

Robert Kiyosaki’s Rich Dad Poor Dad was released in 1997 and it is still regarded as one of the best books in the Personal Finance arena.

Rich Dad Poor Dad is Robert’s story of growing up with two dads — his real father and the father of his best friend, his rich dad — and the ways in which both men shaped his thoughts about money and investing. The book explodes the myth that you need to earn a high income to be rich and explains the difference between working for money and having your money work for you.

The Millionaire Next Door: The Surprising Secrets of America’s Wealthy

The Millionaire Next Door identifies seven common traits that show up again and again among those who have accumulated wealth. Most of the truly wealthy in this country don’t live in Beverly Hills or on Park Avenue-they live next door.

This book talks about things which millionaires do to accumulate wealth and protect it as well. A must have book on finance to achieve financial independence.

Keys to a Successful Retirement: Staying Happy, Active, and Productive in Your Retired Years

Author: Fritz Gilbert

Congrats on your retirement! But now what will you do with all that free time? With Keys to a Successful Retirement, you’ll discover everything you need to know to get your retired years off to a great start.

Covering topics like finances, embracing your passions, and dealing with feelings of aimlessness, grief, and depression that may crop up, this in-depth guide to retired living answers all the burning questions you want to ask―as well as those you’re afraid to. Take a complete look at your newfound freedom and explore what it really means to have a successful retirement.

Conclusion

Listen to these books for FREE on Audible using this link FREE AUDIBLE BOOK

Following advice mentioned in these books on FIRE (Financial Independence, Retire Early) will help you in accumulating wealth but you should also be conscious about protecting your wealth.

Check out this article to learn how wealthy protect their money.

Hope you find this article useful. Please leave a comment and share it with anyone who may find it useful.

Do you shop with upto 50 insurance carriers to get the best rate for insurance?

Do you have an insurance advisor who can guide you about right coverage?

If not, then try https://coverclan.com/ . We will assign an insurance advisor who will shop insurance for you and save time,money and provide peace of mind.

Disclaimer: Some of the links in this article are affiliate links.